Top Trends from the 2024 NAR Profile of Home Buyers and Sellers Every Realtor Should Know

The National Association of REALTORS® (NAR) has just released their 2024 Profile of Home Buyers and Sellers, highlighting key 2024 NAR Trends that can help you stay ahead in today’s changing real estate market. Let’s take a look at some of the key findings and how they can affect your business.

What Do the 2024 NAR Trends Say About First-Time Home Buyers?

One of the biggest takeaways is that first-time home buyers now make up just 24% of the market. This is the lowest level since NAR started tracking these stats back in 1981. With rising home prices and higher mortgage rates, it’s clear that getting into the market for the first time is harder than ever. As a Realtor, it’s important to keep in mind the financial hurdles these buyers are facing.

Understanding their challenges can help you be the supportive guide they need to make the home buying process easier.

Why Are Home Buyers Getting Older in 2024?

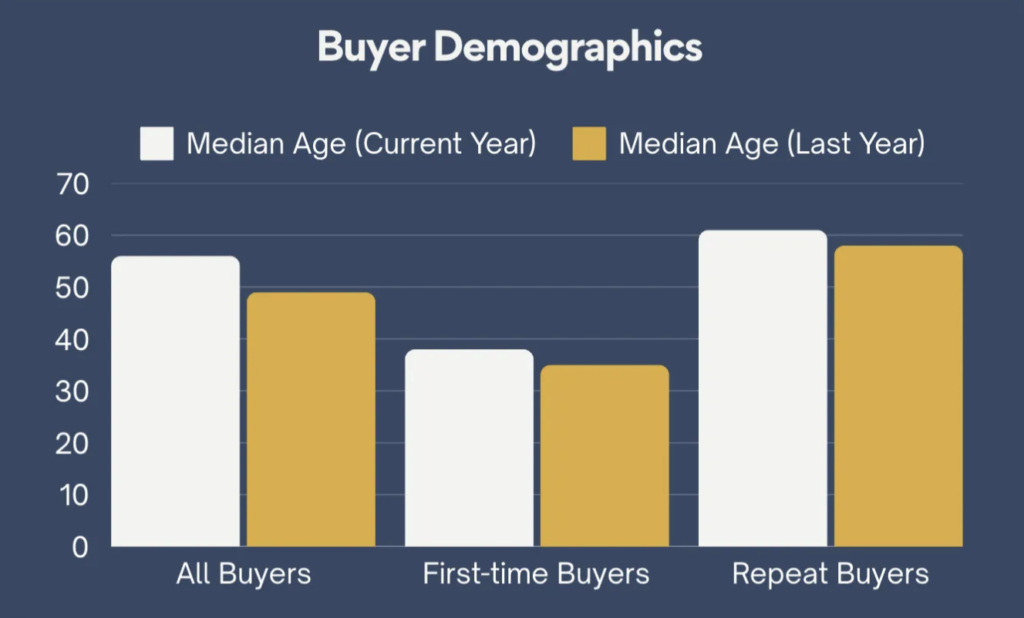

In 2024, the median age of home buyers reached a record high of 56 years. First-time buyers now have a median age of 38, and repeat buyers are averaging 61 years old. According to 2024 NAR Trends, the increasing age of buyers is something to watch closely, as people are waiting longer to purchase homes.

This could be an opportunity for you to specialize in services for older buyers who are looking for their next home, possibly a more manageable or comfortable property.

2024 NAR Trends: How Are Rising Household Incomes Impacting the Housing Market?

In today’s market, home buyers’ household incomes have grown to help keep up with rising home prices and interest rates. The median income for first-time buyers is now $97,000, which is a significant increase compared to previous years. Repeat buyers are doing even better, with a median income of $114,300.

These higher incomes are important because they reflect the reality of the current housing market. With home prices climbing, mortgage rates rising, and overall living costs going up, buyers need to earn more to afford homes. For first-time buyers, especially, this means they must have a solid financial foundation to make a down payment and cover monthly payments.

While it’s encouraging to see incomes rising, the challenges of high home prices and interest rates are still very much a part of the picture. These trends highlight how important it is for buyers to have a good financial plan in place, and as a real estate professional, you can play a key role in helping them understand their options.

Why Are More Buyers Making Bigger Down Payments and Paying in Cash?

According to the 2024 NAR Trends, buyers are now making larger down payments. The overall median down payment is 18%, with first-time buyers putting down a median of 9%.

Repeat buyers are putting down 23%, which is the highest since 2003. Additionally, a record 26% of buyers are purchasing their homes entirely with cash. This shift towards cash purchases and larger down payments is likely to continue, as buyers try to reduce the impact of higher interest rates and home prices.

What’s Driving the Rise in Multigenerational Homes?

An interesting trend is the increase in multigenerational households. Seventeen percent of buyers now purchase homes that will house more than one generation, the highest share ever recorded.

Many buyers are seeking these types of homes to save on costs or to care for aging family members or adult children. As a Realtor, understanding the needs of families looking for more space or flexible living arrangements can help you cater to this growing market.

How Are Neighborhood Preferences Changing for Home Buyers?

When choosing a neighborhood, home buyers are prioritizing things like the quality of the area and the proximity to friends and family. In fact, 59% of buyers now focus on quality, and 45% look for a neighborhood near loved ones. Meanwhile, proximity to jobs is becoming less of a factor, dropping from 52% in 2014 to just 34% in 2024.

This shift may be influenced by the rise of remote work and people seeking a more balanced lifestyle. Understanding these changing preferences can help you guide buyers to neighborhoods that fit their personal priorities.

Why Do Buyers Still Prefer Working with Real Estate Agents?

Even with all the changes in the market, real estate agents are still the go-to resource for most buyers. Eighty-eight percent of buyers worked with an agent to purchase their home. Buyers turn to agents for help finding the right home, negotiating the terms, and understanding the market.

Real estate professionals who provide excellent service and guidance are more likely to have repeat business, with 88% of buyers saying they would work with their agent again or recommend them to others.

How Can These Trends Benefit You as a Realtor?

As you work with clients, keep these trends in mind. The growing number of older buyers means there is a need for homes that are more accessible and comfortable. Buyers may be looking for single-story homes or homes with features that support aging in place. The increase in multigenerational households means families are looking for larger homes with more flexible spaces.

For first-time buyers, offering tools and resources to help them understand financing options, homebuyer programs, and affordable properties can set you apart from the competition. Helping clients manage their expectations in a market with higher prices and interest rates is key to building long-lasting relationships.

What Should Realtors Know About the 2024 Real Estate Market?

The 2024 NAR Trends report highlights several trends that are shaping the real estate market. Higher incomes, changing buyer preferences, and the need for better financial planning are all part of the landscape. As a Realtor, staying informed and offering the best possible advice will help you build stronger relationships with your clients.

How Can Realty Candy Help You Navigate the Latest Real Estate Trends?

With the real estate market constantly shifting, having the right tools can make all the difference. RealtyCandy offers IDXAddons, which include free resources like our Affordability Calculator, Home Valuation Widget and a lot more. These tools help you and your clients make more informed decisions, making it easier to navigate affordability concerns and home valuations.

By using these tools, you can quickly show your clients what they can afford and provide instant property valuations. This helps you add more value to your services, making it easier for clients to find the right home at the right price in today’s market.

If you have any questions or need assistance, feel free to reach out to our support team. We’re here to help!

Data and insights in this post are sourced from the National Association of REALTORS® (NAR) 2024 Profile of Home Buyers and Sellers. For more in-depth insights, you can access the full NAR report here.

Get Access to the 2024 Real Estate Market Report!

Sign up now to receive the full report directly in your inbox!